The 5-Minute Rule for Personal Debt Collection

Wiki Article

Unknown Facts About Personal Debt Collection

Table of ContentsThe Of Debt Collection AgencyThe Ultimate Guide To Personal Debt CollectionMore About Business Debt CollectionThe Personal Debt Collection IdeasRumored Buzz on Personal Debt Collection

You can ask a collector to quit calling you as well as dispute the debt if you assume it's inaccurate.: concur to a repayment strategy, clean it out with a solitary settlement or negotiate a negotiation.

The collector can not inform these individuals that you owe cash. The collection firm can speak to an additional individual just once.

It can, however does not have to approve a partial settlement strategy (Business Debt Collection). A collector can ask that you write a post-dated check, but you can not be required to do so. If you give a collection company a post-dated check, under federal law the check can not be transferred prior to the date composed on it

The finest debt enthusiast task descriptions are concise yet compelling. When you have a solid initial draft, evaluate it with the hiring supervisor to make certain all the information is exact and the needs are strictly crucial.

How Private Schools Debt Collection can Save You Time, Stress, and Money.

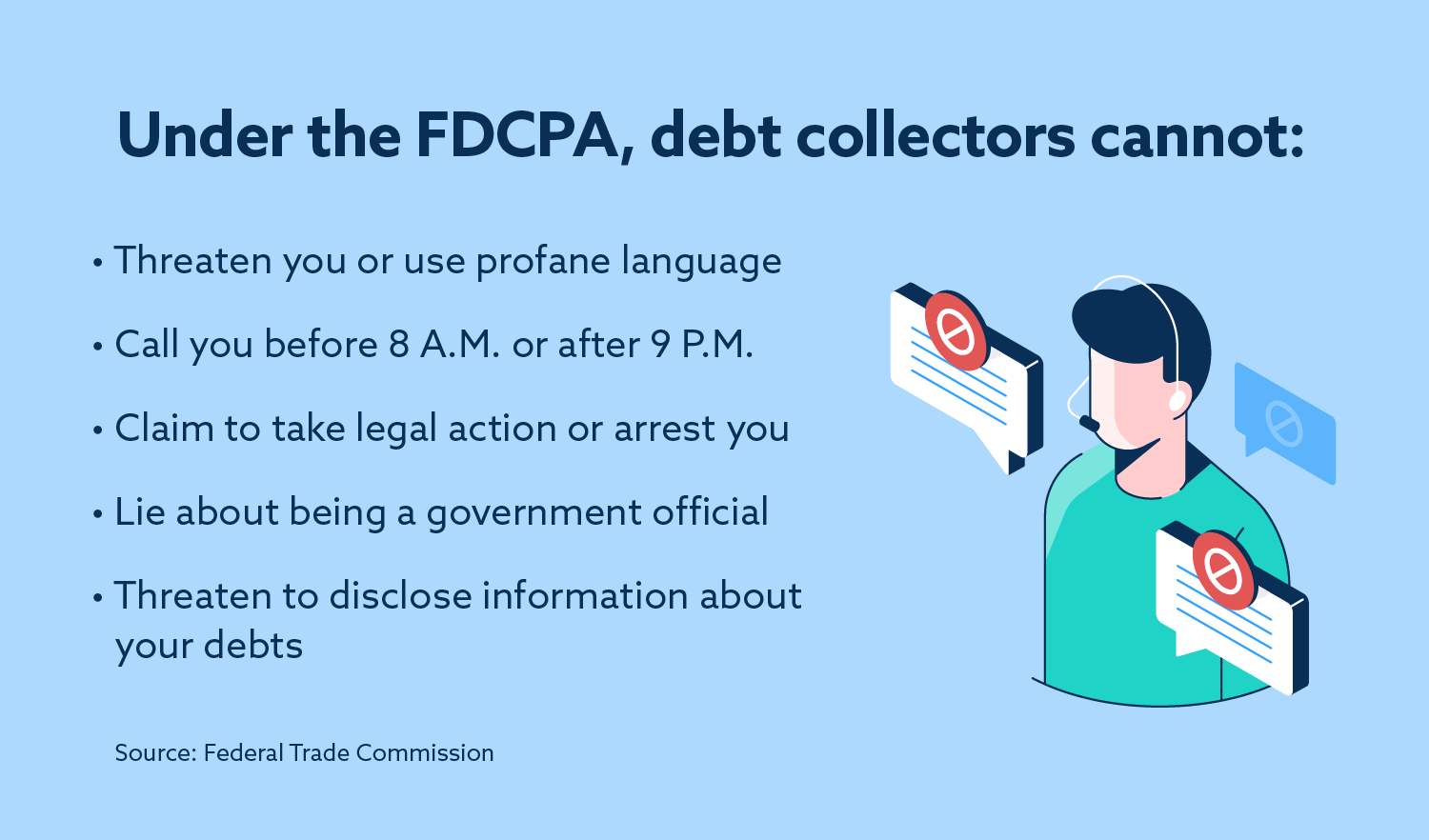

The Fair Financial Debt Collection Practices Act (FDCPA) is a government regulation applied by the Federal Profession Compensation that safeguards the civil liberties of consumers by prohibiting particular techniques of financial obligation collection. The FDCPA puts on the practices of debt collectors and lawyers. It does not relate to lenders who are attempting to recoup their very own financial debts.

The FDCPA does not put on all financial debts. As an example, it does not put on the collection of organization or business debts. It only relates to the collection of debts a specific consumer sustained largely for individual, family members, or home functions. Under the FDCPA, a financial debt enthusiast must adhere to specific treatments when contacting a consumer.

It is not intended to be legal guidance concerning your particular problem or to alternative to the guidance of an attorney.

A Biased View of International Debt Collection

Personal, household and also house financial debts are covered under the Federal Fair Financial Obligation Collection Act. This consists of money owed for treatment, credit account or cars and truck purchases. Business Debt Collection. A debt collector is anybody aside from the financial institution who frequently accumulates or tries to collect financial debts that are owed to others which arised from consumer dealsWhen a financial obligation enthusiast has informed you by phone, he or she must, within five days, send you a written notice revealing the amount you owe, the name of the creditor to whom you owe money, and what to do if you dispute the financial obligation. A financial debt enthusiast might NOT: harass, oppress or abuse any individual (i.

You can quit a financial debt enthusiast from calling you by creating a letter to the collection firm telling him or her to stop. Once the company receives your letter, it navigate to this website may not contact you again other than to alert you that some specific activity will certainly be taken. A debt collection agency may not call you if, within thirty days after the collector's very first get in touch with, you send out the collection agency a letter mentioning that you do not owe the cash.

Not known Facts About Business Debt Collection

This material is readily available in alternative style upon request.

Rather, the lending institution may either image source enlist a firm that is worked with to gather third-party financial debts or market the debt to a collection firm. When the debt has actually been offered to a financial obligation debt collection agency, you might start to obtain telephone calls and/or letters from that firm. The financial obligation collection industry is greatly managed, as well as debtors have several civil liberties when it comes to handling bill enthusiasts.

In spite of this, financial debt collection agencies will certainly try every little thing in their power to get you to pay your old financial debt. A financial obligation collector can be either a private person or a company. In either situation, their task is to accumulate overdue financial debts from those who owe them. In some cases described as collection professionals, an individual financial obligation enthusiast might be accountable for numerous accounts.

Financial debt collection firms are employed by financial institutions and also are generally paid a portion of the quantity of the debt they recover for the why not try here lender. The percent a collection company charges is commonly based on the age of the debt and the amount of the debt. Older financial obligations or greater financial obligations may take more time to collect, so a debt collection agency could bill a higher portion for gathering those.

Business Debt Collection for Beginners

Others service a backup basis and also just charge the financial institution if they achieve success in collecting on the debt. The financial obligation collection firm gets in right into a contract with the creditor to gather a portion of the debt the percent is stipulated by the financial institution. One creditor may not be willing to go for much less than the sum total owed, while an additional might accept a negotiation for 50% of the debt.Report this wiki page